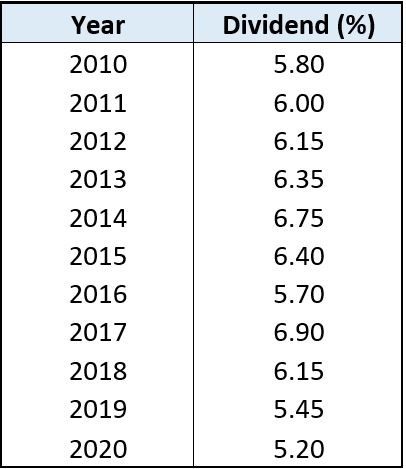

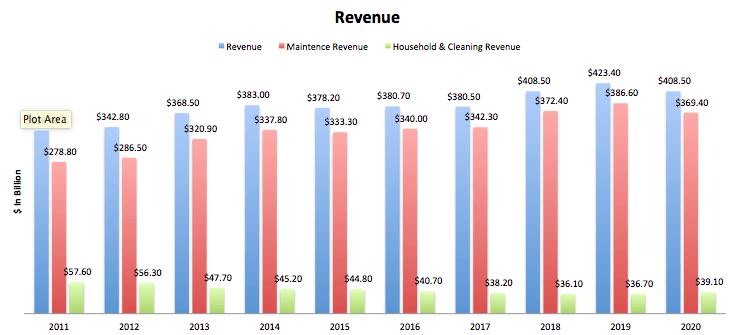

Heres the dividend rates for the past 10 years. Put another way the EPF will likely need to have RM35 billion to RM40 billion to pay a 5 dividend for 2018.

Epf Declares Dividend Payout Rates For 2018

In Issues 1348 Dec 7 2020 and 1350 Dec 21 2020 The Edges extrapolation of the EPFs 2018 savings among active members showed that instead of the blanket single-tier dividend of 615 for conventional savings in 2018 it is possible to pay an effective dividend rate of more than 7 to members with savings below RM50000 if savings.

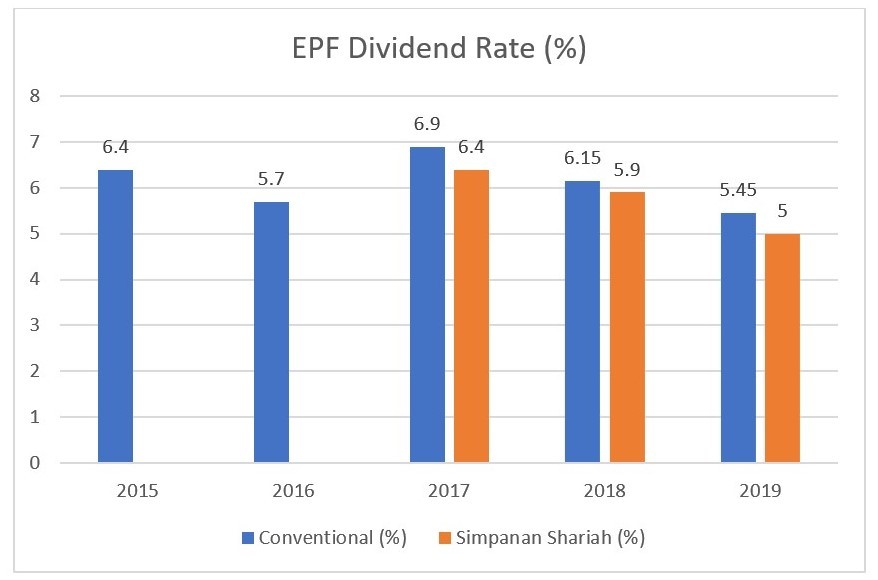

. The last rate that you opt for will be your new contribution rate and will remain as so. The Employees Provident Fund EPF has declared dividend rates for both Conventional and Shariah savings in 2018. According to China Press Datuk Shahril Ridza Ridzuan the Chief Executive Officer of EPF said that the dividends are at a rather comfortable rate.

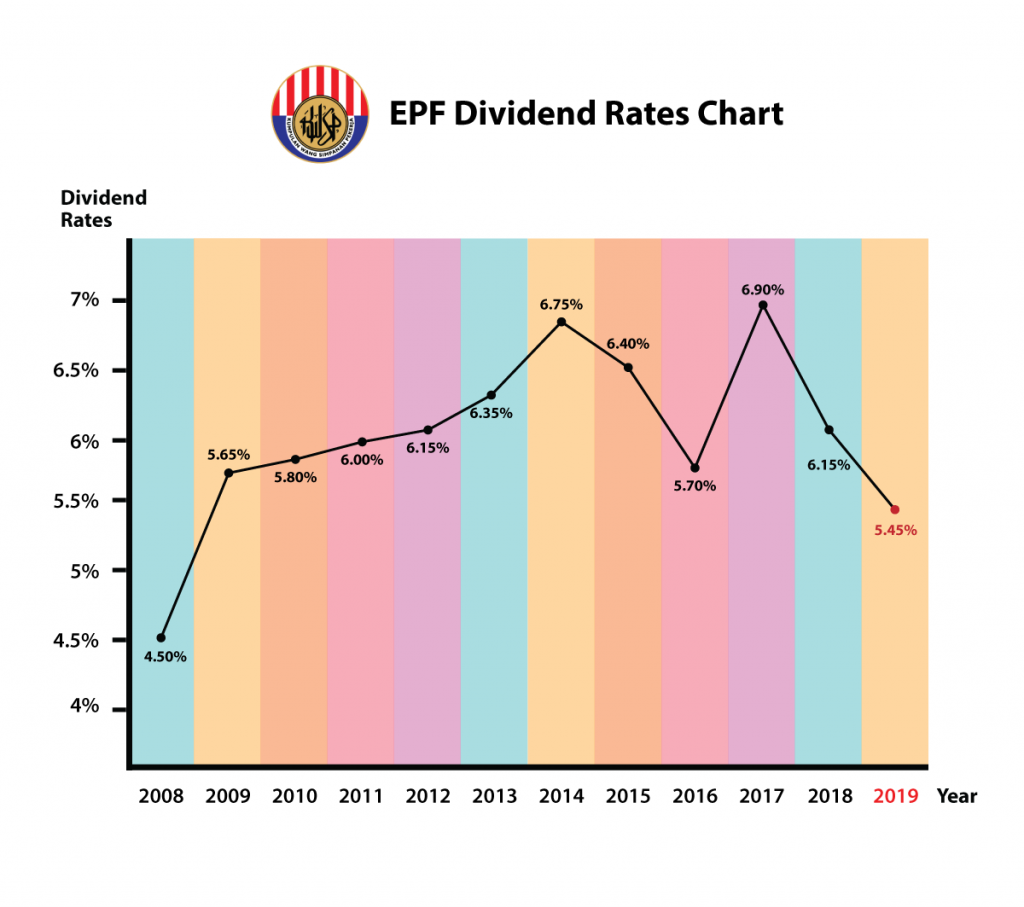

The highest was when its first introduced in the year 1983 with a dividend rate of 850. Even if the figure is likely lower year on year the returns are. KUALA LUMPUR Feb 16.

The Employees Provident Fund EPF remains tight-lipped on the 2018 potential dividend payout. However it looks like the dividend rate for 2017 is set to be higher than last years rate. For a 6 dividend the EPF would probably need to have made RM42 billion to RM46 billion last year which means a 6 dividend for 2018 is a tall order in a tough year.

He said that they expect the dividends to be higher than last year possibly around 65 to 75. According to EPF the dividend rate for Conventional Savings stands at 615 which amounts to RM42 billion in payout while the dividend rate for Shariah savings is 59 total payout of RM432 billion. The Employees Provident Fund EPF has declared a dividend rate of 615 for Conventional Savings 2018 with payout amounting to.

On 10 February 2018 EPF announces that the EPF dividend for 2017 is 69 konvensional saving and 64 shariah savings. Dividend rate is calculated based ont the lowest dividend declared between the Simpanan Konventional and Simpanan Shariah. The Employees Provident Fund EPF has declared a dividend rate of 615 percent for Conventional Savings 2018 with payout amounting to RM43 billion and 59 percent for Shariah Savings 2018 with a.

Dividend Rate Conventional Account. Salary for January 2018. The dividend payout for 2021 shows that EPF is well on the road to recovery from the dire economic situation brought about by the pandemic as this is the highest dividend payout declared for conventional savings since 2018 where the dividend payout was 615.

The EPF dividend rate has been dropping since the year 1988. Listed below are the yearly dividend rates paid out by EPF beginning 1952 until now 2019. EPFKWSP Dividend Rates History.

Many people are concerned about how much the EPF will pay dividends. But all indications point to the EPF declaring a much lower dividend rate than the. Even if the figure is likely lower year on year the returns are.

The Centre has approved a four-decade-low interest rate of 81 percent on Employees Provident Fund deposits for 2021-22 down from 85 in the previous yearThis will pave the way for crediting the interest into the accounts of over sixty million EPFO subscribers in 2021-22 earlier than usual. For a 6 dividend the EPF would probably need to have made RM42 billion to RM46 billion last year which means a 6 dividend for 2018 is a tall order in a tough year. Put another way the EPF will likely need to have RM35 billion to RM40 billion to pay a 5 dividend for 2018.

According to economists forecasts the payout rate is expected to range from 52 to 6 in 2021 due to higher total investment by the Employees Provident Fund Board EPF and better capital market. Pic by the Star. May choose to contribute more than the stipulated rates under the Third Schedule to the EPF Act 1991.

3 Key Things You Need To Know About Employees Provident Fund Epf

Epf Historical Returns Performance Mypf My

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

Hul Dividend Payout History Yield

Epf In A Low Interest Rate Environment

Invest Made Easy For Malaysian Only Historical Epf Annual Dividend Rate

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

5 Year Low Interest Rate Of 8 5 For Epf Announced Low Interest Rate Interest Rates Mutuals Funds

Mbsb 1171 Technical Analysis Analysis Chart

Tds Rates Chart Fy 2017 18 Ay 2018 19 Tds Deposit Return Due Dates Interest Penalty Simple Tax India Tax Deducted At Source Lottery Dividend

Epf Dividend Of 5 Possible 6 May Be Difficult The Edge Markets

Maturity Pattern Of Fixed Deposits With Banks In India 2015 To 2019 Investing Investment In India Data

Wd 40 Company Has Declined By 30 But Is Still Overvalued Nasdaq Wdfc Seeking Alpha

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

6 15 Pct For Conventional Savings 5 9 Pct For Shariah

Maturity Pattern Of Fixed Deposits With Banks In India 2015 To 2019 Investing Investment In India Data

Epf Dividends For 2020 Could Be On Par With 2019 Or Just Slightly Less

The 8th Voyager Epf Declared 6 15 Conventional 5 90 Shariah Dividend For 2018